Virginia Education Improvement Scholarships Tax Credit Program

Virginia Education Improvement Scholarships Tax Credit Program

Virginia provides a state tax credit for persons or businesses that make a monetary donation to an approved scholarship foundation that provides scholarships to eligible lower income or disabled students for qualified educational expenses incurred in attending eligible nonpublic schools. ACSI (Association of Christian Schools International) has a qualified scholarship foundation program called the Children's Tuition Fund (CTF) and Williamsburg Christian Academy is a member of ACSI. Thus a donation to the Children's Tuition Fund can be directed to WCA for the scholarship program and qualify for the Virginia tax credit.

For individuals, the credit is limited to a contribution of $125,000 per year. For businesses, the credit is not limited. The credit is 65% of the contribution amount.

Depending on your other income, your itemized deductions may be limited, but following is an example of the cost.

Donate $1,000 $5,000 $10,000

VA Credit $650 $3,250 $ 6,500

Federal Tax Savings* $122.50 $612.50 $ 1,225

Total Tax Savings $772.50 $3,862.50 $7,725

*The federal tax savings will depend on your tax bracket and only applies to the remaining 35% of the contribution after the credit is applied. The example above assumes a personal/business tax bracket of 35%.

In summary, you are still out the cash you would have had to pay in taxes anyway, but the majority of it goes to Williamsburg Christian Academy instead of the government. Please note, itemized deductions may be limited based on your overall income, so the numbers represented are used for illustration purposes. Please consult your tax preparer to see the benefit to you.

This process is now entirely online. Simply visit this link, and you can make your contribution today (please follow the listed instructions and do not click the 'Contribute Now' button on the VEI page).

If you have any questions or confusion regarding this process, we stand ready to help. Call us at 757-378-5265, or email us at hoa@williamsburgchristian.org. We've also provided our VEI donor forms walkthrough at the bottom of this page.

Thank you for your thoughtful and prayerful consideration of this opportunity and for your ongoing support of the WCA school ministry.

VEI Donation Forms Walkthrough

Need a little help filling out your VEI donation forms? We have taken the process apart and created this tutorial with step-by-step instructions on how to complete them, whether you are a first time VEI donor, or have given before but just need a refresher. Note that this walkthrough is written to accompany the Children's Tuition Fund checklist, found here.

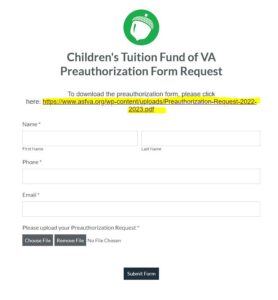

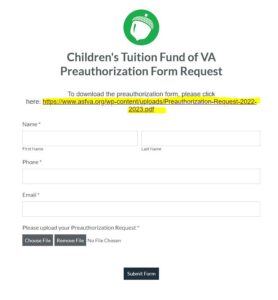

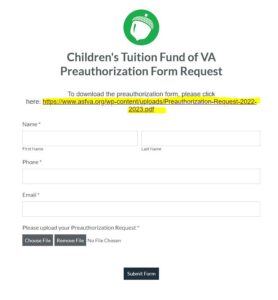

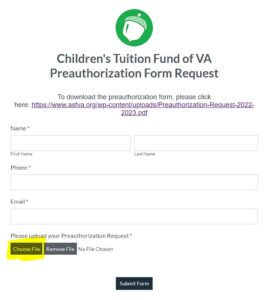

WCA uses the Children's Tuition Fund for our third-party administrator foundation, where the WCA contributions are collected. The Children’s Tuition Fund (CTF) handles our pre-authorization, donation, and funding. The first step on their website is to download and fill-in the pre-authorization form, which is provided by clicking the 'Click here button in step 1:

In the window that follows, there is a link listed below the Children's Tuition Fund Logo. Click on that link to open the Pre-authorization form and print it (the form will require a signature).

Please note that as of 2022 for individuals, the minimum donation for the issuance of tax credits is $500 in a taxable year, and the maximum aggregate donations for the issuance of tax credits are $125,000 in a taxable year. An individual that has already been issued tax credits for donations of $500 or more to a scholarship foundation can be issued tax credits for additional donations to the same scholarship foundation that are less than $500, provided that the additional donations are made in the same taxable year. There are no limitations for businesses.

Complete the Pre-authorization form and sign it in the very limited space provided at the bottom. Once you have filled out your pre-authorization letter submit your document to the Children’s Tuition Fund website (STEP 2) or mail in your information. We recommend you choose to submit your pre-authorization on their website as it is a much faster process.

To submit your pre-authorization letter to the Children's Tuition Fund organization, you will need to scan your signed document so you have a digital file copy (usually a .pdf or .jpeg file). Save it somewhere it will be easy to find when you need to upload it!

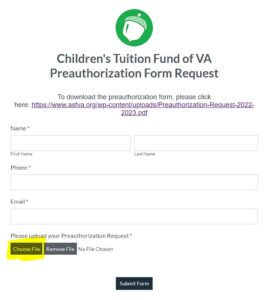

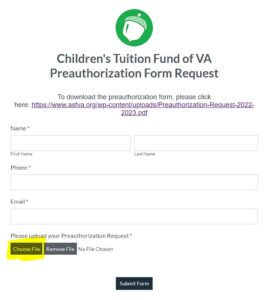

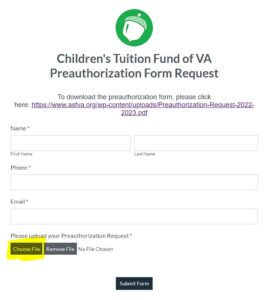

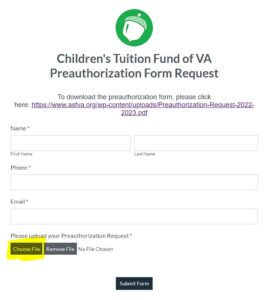

Go back to the CTF website, follow step one, and its 'Click Here' button to its following page, this time filling out the personal information boxes provided. Once you have filled in that information, you will need to upload your completed and signed pre-authorization form. This can be done by scanning it, or if you do not have scanning capability, taking a well-lit photo of the signed document.

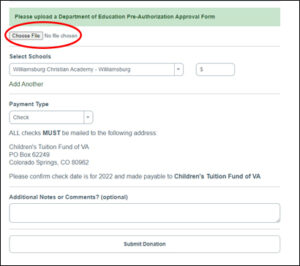

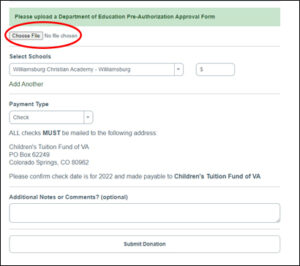

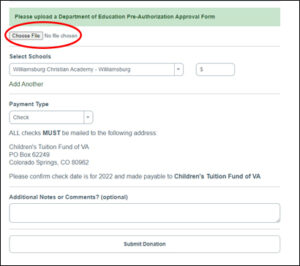

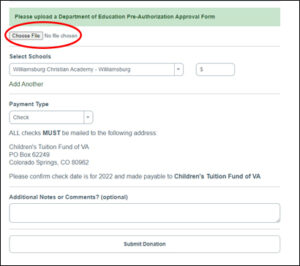

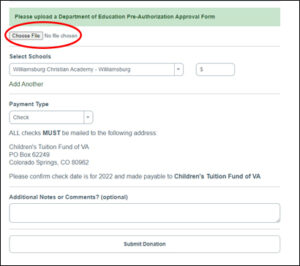

Select the Choose File button on the bottom of the page, and find your scanned or photographed digital copy of your preauthorization form. The file name should now be listed next to the buttons. Click 'Submit Form' to proceed.

After you submit this form CTF will send you a copy of your "Preauthorization Notice" usually within a few hours via email.

After you receive your preauthorization notice form you will be ready to submit your donation. Go back to the main checklist from the Children's Tuition Fund Website and proceed to Step 4. Click on the 'Click Here' box to open the donation portal:

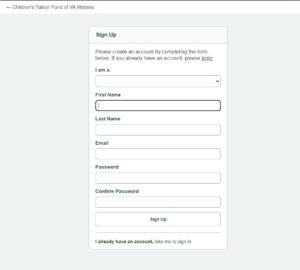

Select the state you are contributing to as Virginia.

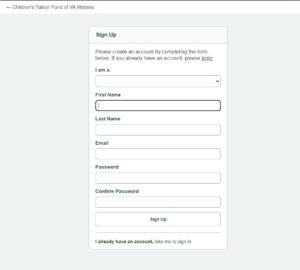

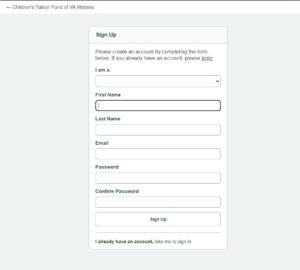

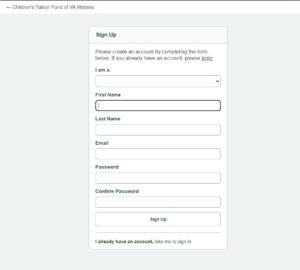

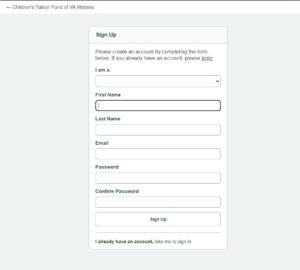

You will then be brought to a log-in or sign-up page. If you do not have an account you can create one now or log in to your existing account. If you donated previously, but have forgotten your password since it was a year since you last logged in likely, you can recover it, a process that takes about 5 minutes or so.

Click the 'Donate Now' button on the following page to continue.

Finally, you will be taken to the last form, where you will select either personal or business, enter the appropriate info, and attach the pre-authorization notice you received over email using the "Choose File" button seen in the screenshot below. You will select the school you choose to contribute to (Williamsburg Christian Academy) and the dollar amount that you are pre-authorized to donate.

You can choose to pay via check, Credit Card, ACH, or Stock. Each payment type will have unique sections you will need to fill out to complete your payment.

After you submit your payment CTF of VA will process your contribution with the VDOE and notify your selected school.

Once scholarship recipients are selected, funds will be sent to the school directly. It usually takes a few hours for WCA to receive the donated funds if submitted electronically.

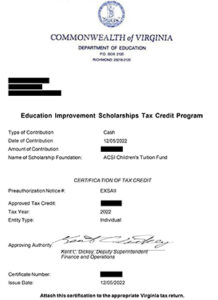

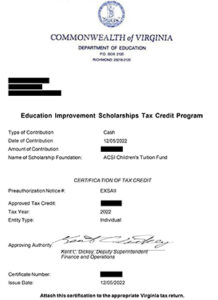

Once you have completed your contribution, the Children's Tuition Fund will email you a copy of the VA Tax Credit Certificate that you will provide with your VA tax return (yourself or via a tax preparer) to substantiate the tax credit. A redacted copy of an actual EIS Tax Credit Certificate is shown below.

If you have any questions or choose to submit your pre-authorization letter via mail please contact our Head of Administration at WCA at hoa@williamsburgchristian.org or 757-378-5265. If you know of anyone who would like to receive a tax credit and would like to donate to WCA please share this page with them for more information on what is VEI and how it can benefit them through tax credits and deductions.

#HowWeEagle

Williamsburg Christian Academy is a Charitable Non-profit 501(3)c organization, Federal Tax Exemption (DLN) Number: 17053218311034